Wine over gold: Investing in wine can have 15% appreciation

Quality wine can be more than just good company for your evenings. Bottles of vintage wine are an increasingly popular investment vehicle. In the Czech Republic, the annual appreciation of wine is most often in the range of 10-15%. For a better idea – in the case of gold it is an average of 4.7%. Do you want to upgrade your hobby and become an investor? In this article, we’ll give you tips on how to do it.

It’s worth investing in wine

Experts rank investments in wine as one of the safest investment assets. The volatility of wine prices is low – there are no aggressive price fluctuations. Old wines in particular are gradually decreasing on the market and thus becoming rare goods. The high demand for old wines also helps the low volatility. As soon as there is a preponderance of demand over supply, the price of wine will naturally rise.

Think of investing in wine as more of a long-term process. For its appreciation, the wine must still age in the archive for years. A bottle of wine usually achieves its highest value over a period of 10 to 20 years. In addition, if you invest in wine regularly and over a more extended period of time, you will reduce the risk of financial loss due to “weaker” years.

Let’s take a look at the other benefits that buying investment wine will bring you:

- Investment wine returns do not correlate with conventional financial asset returns. The wine is not connected with them in any way, so they cannot negatively affect its profit.

- Wine belongs to investments with a low number of loss periods.

- The demand for investment in wine is growing steadily, while bottles of old wines on the market are decreasing. So you don’t have to worry that there will be no interest in your wines when it comes time to evaluate them.

However, the prerequisite for a profitable investment is the most important thing – the right bottle of wine. Not every bottle is suitable for storage in the archive, and not every wine will attract the interest of potential buyers at a subsequent sale. But we’ll get to choosing the right bottle in a little while.

Investment wine saved the French during the pandemic

The pandemic has shuffled the cards in the market for investment wines. Closed restaurants and the impossibility of going on vacation caused people to focus on investing in quality wines. Moreover: Wines have earned investors the most of any luxury investment product during the pandemic. While the average price of luxury watches and cars rose by around 4%, investment wines significantly surpassed them by 13%.

The most successful on the market were wines from the famous French regions of Bordeaux, Burgundy and Champagne.

Tip: Get to know Bordeaux, the homeland of the world’s best wines, in our separate article.

How much will investment wine earn you?

If you are thinking about investing in wine, you are probably interested in the most important thing – what profit can be expected. In the Czech Republic, the annual appreciation of investment wines is between 10 and 15%. But arm yourself with patience. Investment wine will reach the highest price on the market in 10 or even 20 years.

Before buying investment bottles, think and try to answer important questions for yourself. These and other variables have a significant impact on how much the sale of investment wine will bring you:

- How much do you want to invest in buying wine?

- Will you make a one-time purchase or will you invest regularly and spread the wine purchase over time?

- How long do you wish to invest in wine and in how many years do you wish to sell your first bottle?

- Will you buy luxury wines purely for investment purposes or do you also plan to taste some of them?

Is your plan set? If so, the fun part can start. The choice of the right investment wine!

You must choose your investment wine correctly

You probably know that not all wines are suitable for buying to enhance your savings. Investment wine must meet important criteria:

- The production of it should be fairly limited. That’s a standard procedure in the case of luxury wines. Producers use only the best grapes for the production of their premium wines.

- It comes from a famous winery.

- It has excellent ratings and is in high demand. You can easily find out the price of individual wines on the market thanks to one of the wine applications.

- It must be suitable for archiving. In our article, we wrote about the characteristics by which you can recognize wine for archiving.

It is most advantageous to buy a young wine with the potential to be archived, let it mature in the archive and only then sell it.

Investment wines are mainly the most prestigious wines from Bordeaux, which are often sold before they are bottled at the winery, so your best bet is to look for reds from French wine regions, especially Bordeaux and Burgundy. You can usually leave these wines to mature in the archive for decades. Thanks to this, you do not have to worry that there would be no interest in them when you want to sell them. Long years in the archive will turn your wines into rare gems.

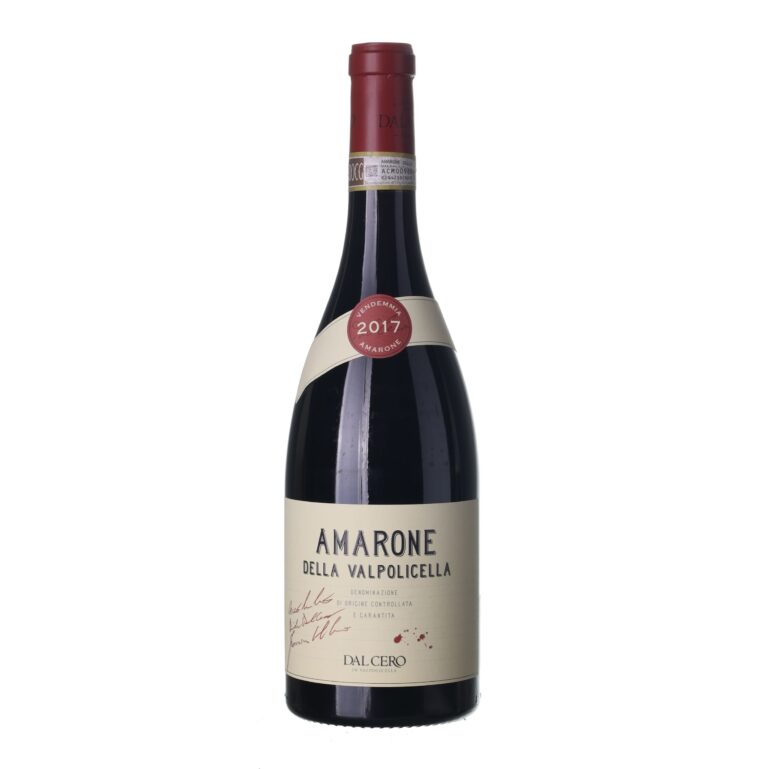

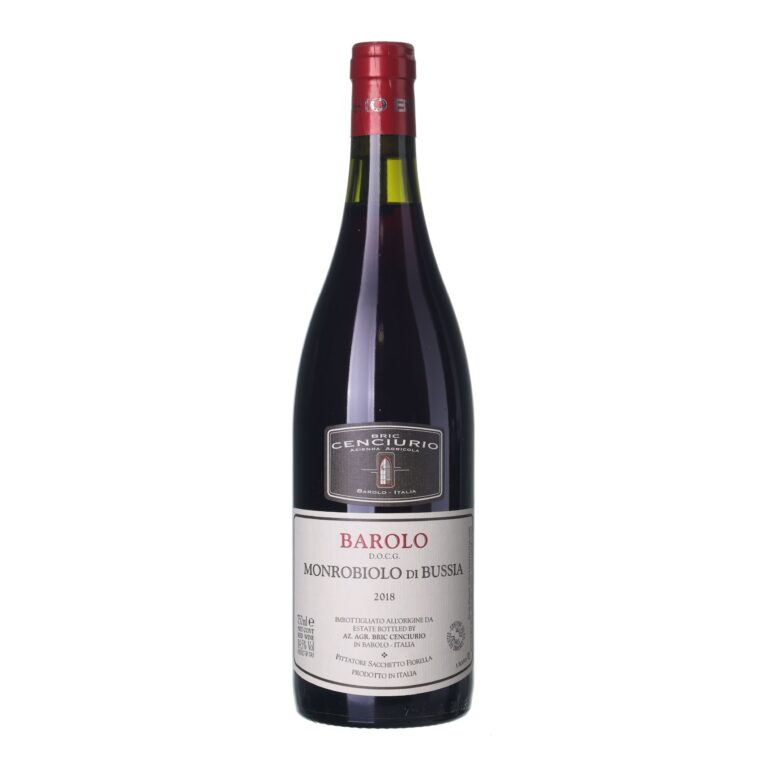

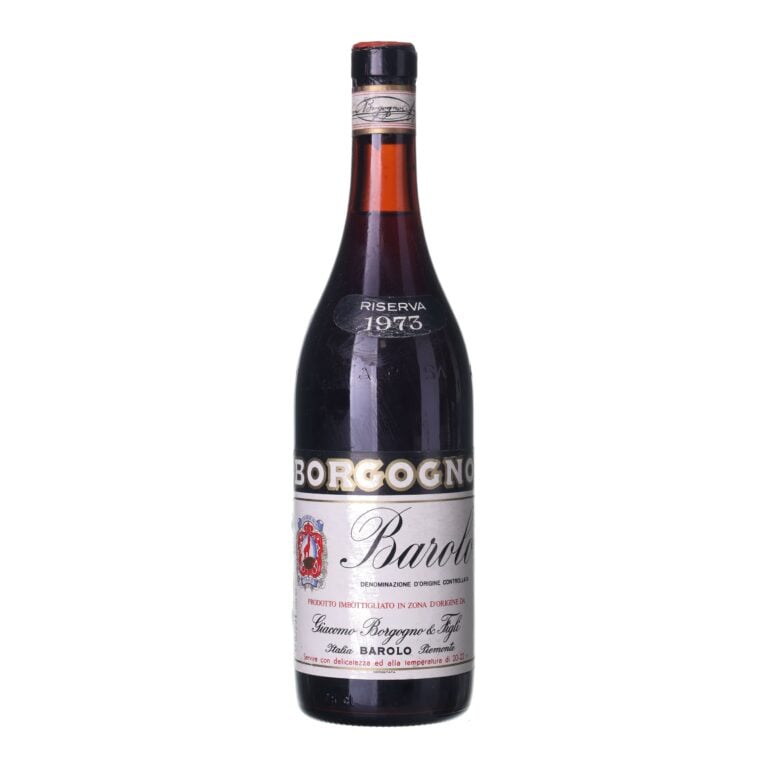

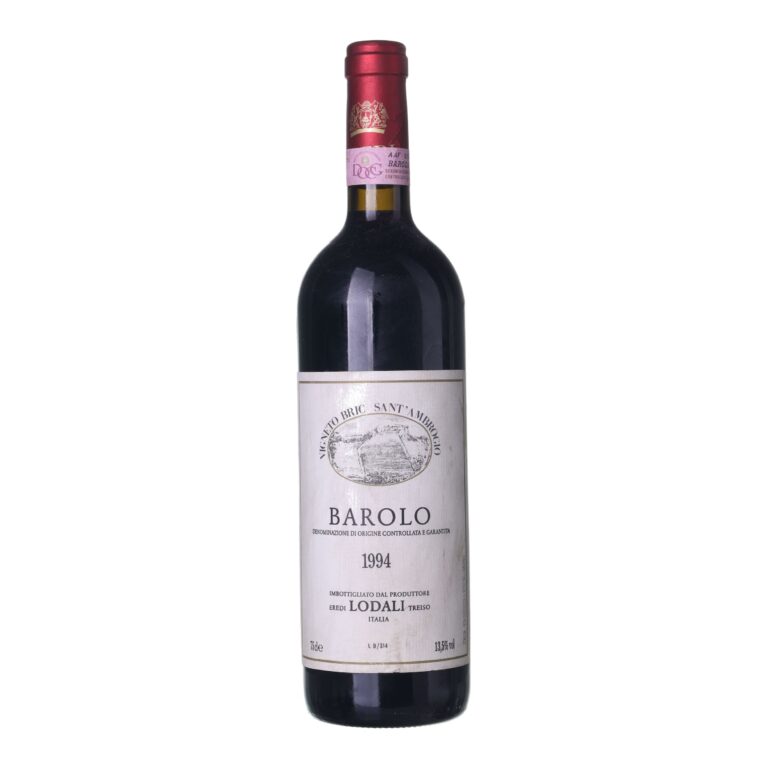

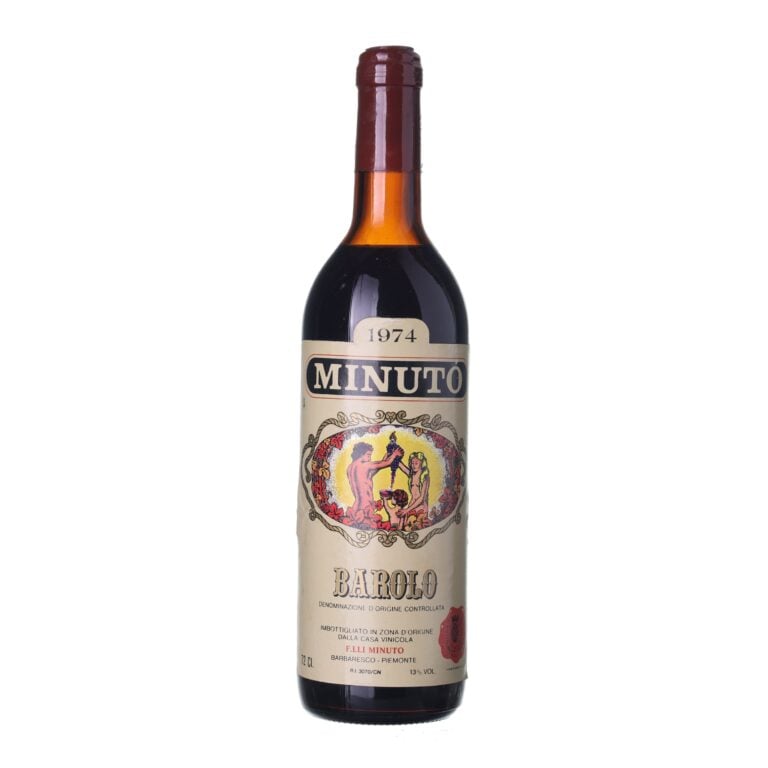

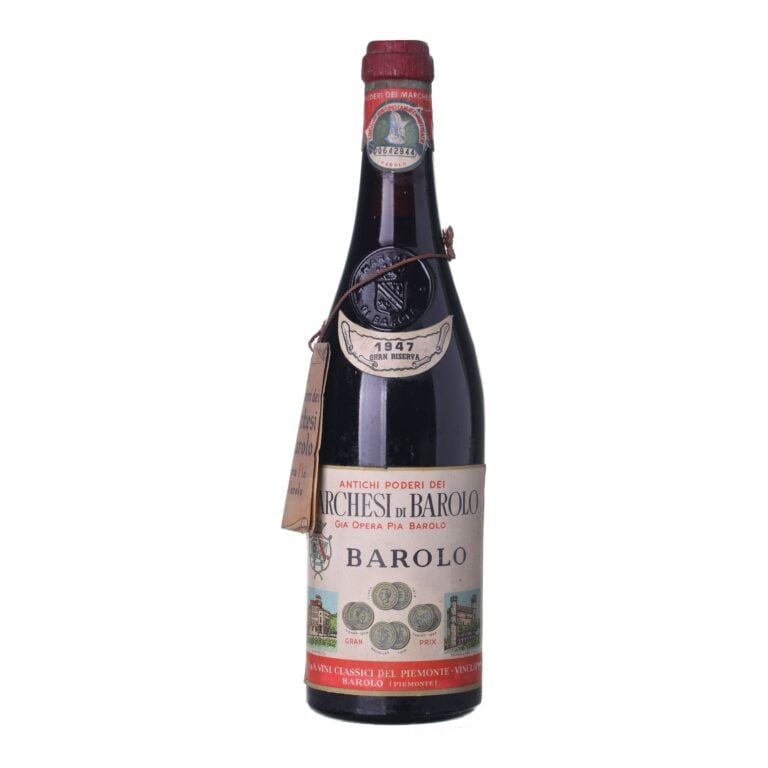

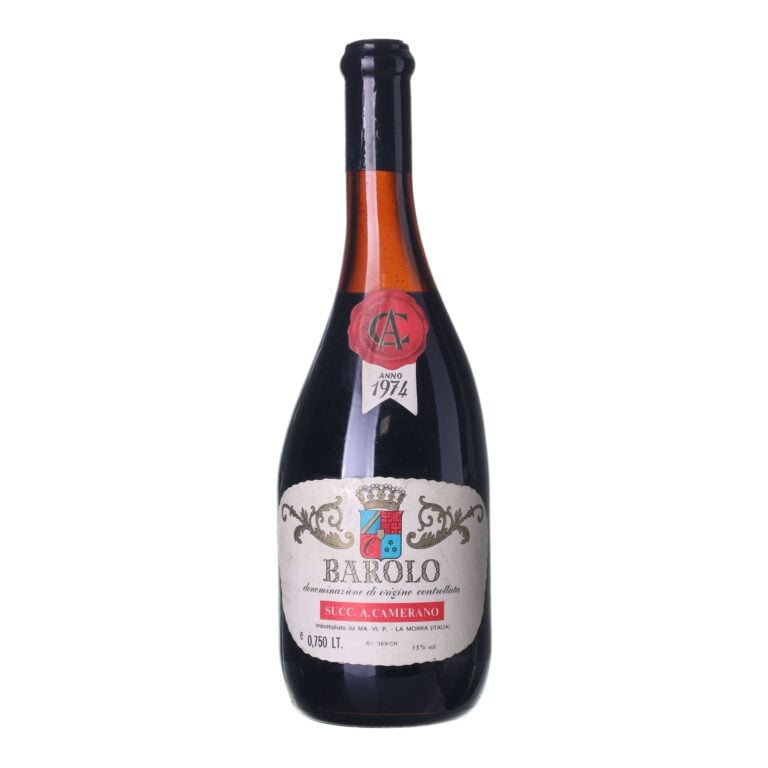

A tip for investment wine from Italy

Are you considering expanding your wine investment portfolio to include bottles from regions outside the French borders? Focus your attention on Italian wines. These are the ones that investors focus on more and more these days. This is confirmed by the fact that in the first half of 2020, the price of Italian wines skyrocketed.

Make your vintage collection special with, for example, a famous representative from the Italian region Piemonte – Barolo. These red wines have a high aging potential and you can leave them in the archive for at least ten years. Read in our article why Barolo is called the “king of wines”.

A tip for French investment wines

You already know that it pays to invest especially in wines from the French wine region of Bordeaux. We stock some great wines from the most famous part of Bordeaux – from the Médoc region. The wines from the local Château Saint-Hilaire winery, due to their ageing potential, are wonderfully suitable for archiving.

Tip: Are you interested to learn more? Find out why Médoc wines are so special.

You have to store investment wine properly, otherwise, it will get spoilt

In order to prevent your luxury wine from spoiling, you have to ensure it has the right conditions for ageing correctly:

- Optimal stable temperature and humidity.

- Storing the bottles in a horizontal position so that the cork is submerged at all times and does not dry out. This prevents oxygen from getting into the bottle, causing the wine to age prematurely.

- Darkness – UV radiation from light speeds up the wine ageing process.

- It is also not advisable to move the wine too much. By shaking the bottle, you could stir up the tiny particles that settle at the bottom of the bottle and the wine would lose its characteristic bouquet.

Does archiving wines sound like rocket science to you? Our article about keeping vintage wines will show you that it’s quite simple and with just a small effort even a complete beginner can manage it.

Select wines. In your email.

once every month. You can look forward to our recommendations, interesting content, and great offers for your archive for your archive.

By sending an email you agree to the Terms and Conditions for Protection of Personal Data